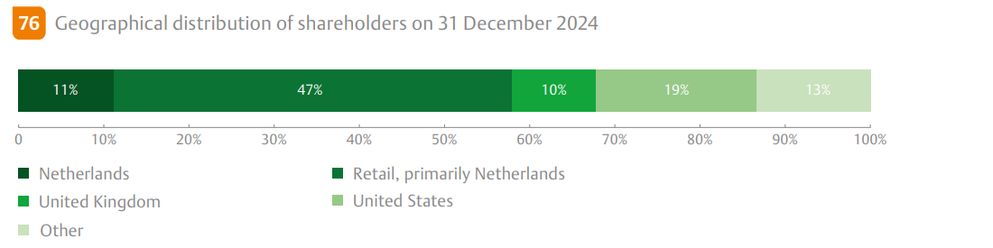

Shareholders

BAM closely monitors developments in its shareholder base through market information and a yearly shareholder identification report. Under the Dutch Financial Supervision Act, shareholders must disclose to the Dutch Authority for the Financial Markets (AFM) when they hold 3% or more of shares and when they transfer to a different threshold level. At year-end 2024, the aggregate holdings of funds controlled by Acadian Asset Management, Ahlström Invest bv, Dimensional Fund Advisors, Moneta Asset Management and The Vanguard Group each surpassed 3% in BAM’s share capital. BAM holds 20.5 million treasury shares, of which 3.9 million shares are allocated for the long-term incentive plan.

In 2024, BAM executed a €30 million share buyback programme. Total shares qualifying for dividends declined by 5,454,432 at the end of 2024 versus the start of the year.